Why AI Mention Tracking Software Is a Game‑Changer for Investors

Brands often struggle to keep up with how, where, and why people mention them online. Missed mentions can lead to lost opportunities, unmanaged crises, and overlooked customer feedback that harms brand reputation. Manual monitoring is time-consuming and incomplete. That’s where AI mention tracking software comes in automating real-time brand monitoring to help businesses stay alert, analyze sentiment, and act strategically before small issues escalate.

What Is Mention‑Tracking Software?

Mention‑tracking software monitors whenever a company, executive, product, or sector is mentioned online, across social media, news websites, podcasts, forums, and even regulatory filings. Unlike generic listening tools, AI‑driven mention trackers go deeper. They use natural language processing to detect emotion, trend direction, and influence level.

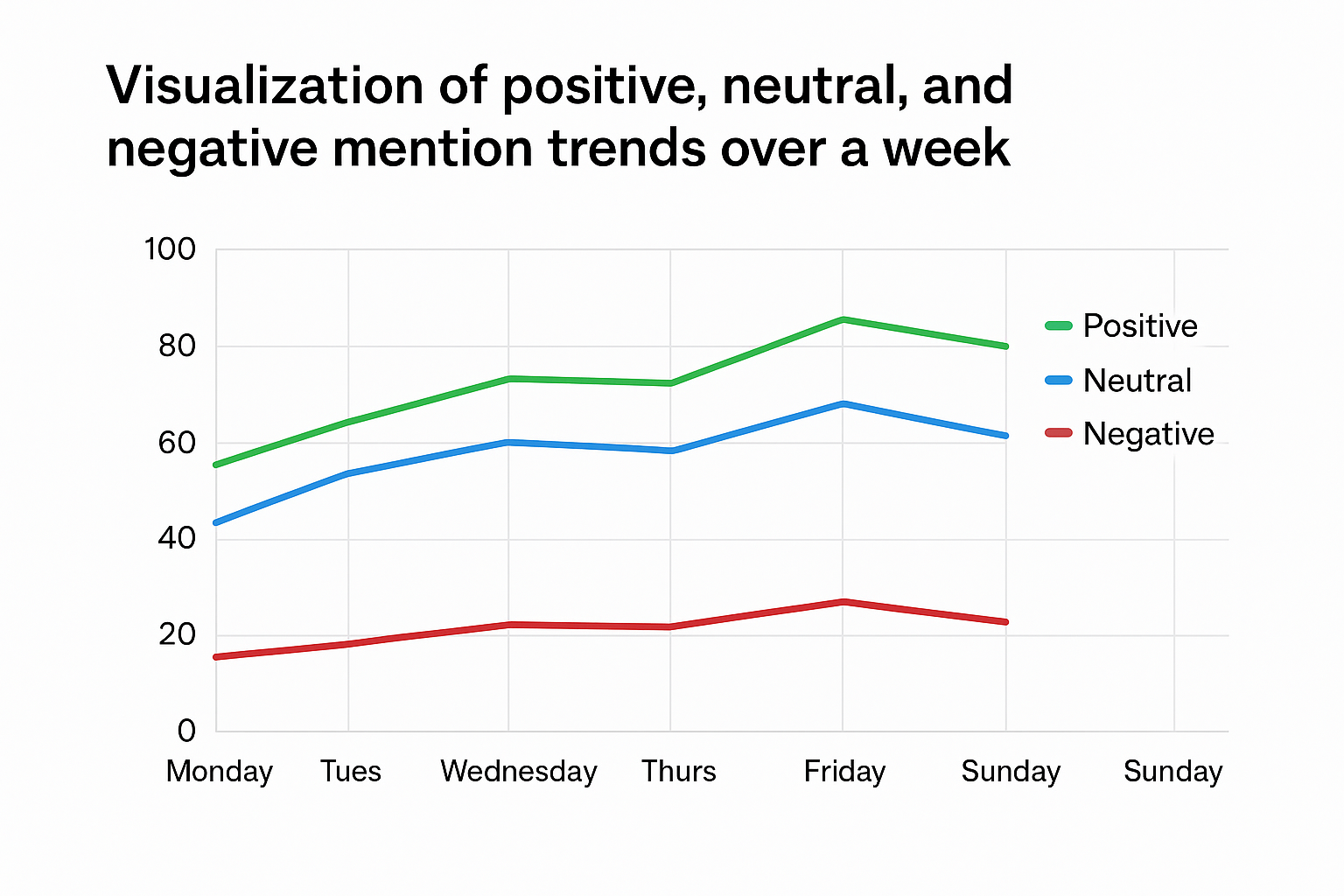

Core features include real‑time alerts, sentiment analysis, spike detection (volume changes in mentions), influencer tracking, and entity recognition. For investors, this means getting early warnings before the market re‑prices a story.

![]()

Why Investors Should Care

Markets thrive on perception. Whether the sentiment comes from journalists, analysts, or social communities, collective opinion moves stocks. Traditional research tools are often delayed; by the time a quarterly report or analyst note arrives, social data may already hint at trajectory changes.

AI mention‑tracking changes that. It collects open‑source chatter and transforms it into usable signals. Early detection of a negative sentiment surge like product recalls or executive controversies can forecast risk before it hits earnings. Similarly, a steady stream of positive mentions may indicate confidence or innovation traction before major analyst upgrades.

In an age where information spreads at lightning speed, being the first to interpret online sentiment can separate proactive investors from reactive ones. A 2024 Investopedia report found that over 90% of institutional investors use AI systems to process alternative data sources, including mentions and social signals. That’s competitive intelligence anyone can now access.

Key Features to Evaluate in Your Mention‑Tracking Tool

Before choosing any AI visibility tool or ChatGPT tracking tool, understand what differentiates a reliable mention tracker.

- Real‑time alerts to detect market‑affecting chatter instantly.

- Multi‑channel coverage (financial media, Reddit, X, YouTube comments).

- Sentiment scoring that shows whether talk is favorable or concerning.

- Volume spike detection and historical comparisons to identify anomalies.

- Automatic entity recognition linking mentions to CEOs, brands, or sectors.

- Integration compatibility with your portfolio platforms or CRMs.

- Data export and APIs for deep integrations, particularly for businesses seeking Ai integration servies.

- Transparent pricing models to assess ROI.

When assessing AI mention‑tracking software, ensure it covers your focus industries. For investors, tools like LLMClicks.ai, Brand24, or Talkwalker offer adaptable dashboards to integrate predictive AI layers.

How to Integrate Mention‑Tracking into Your Investment Workflow

Using AI mention‑tracking effectively requires planning. Here’s a straightforward approach:

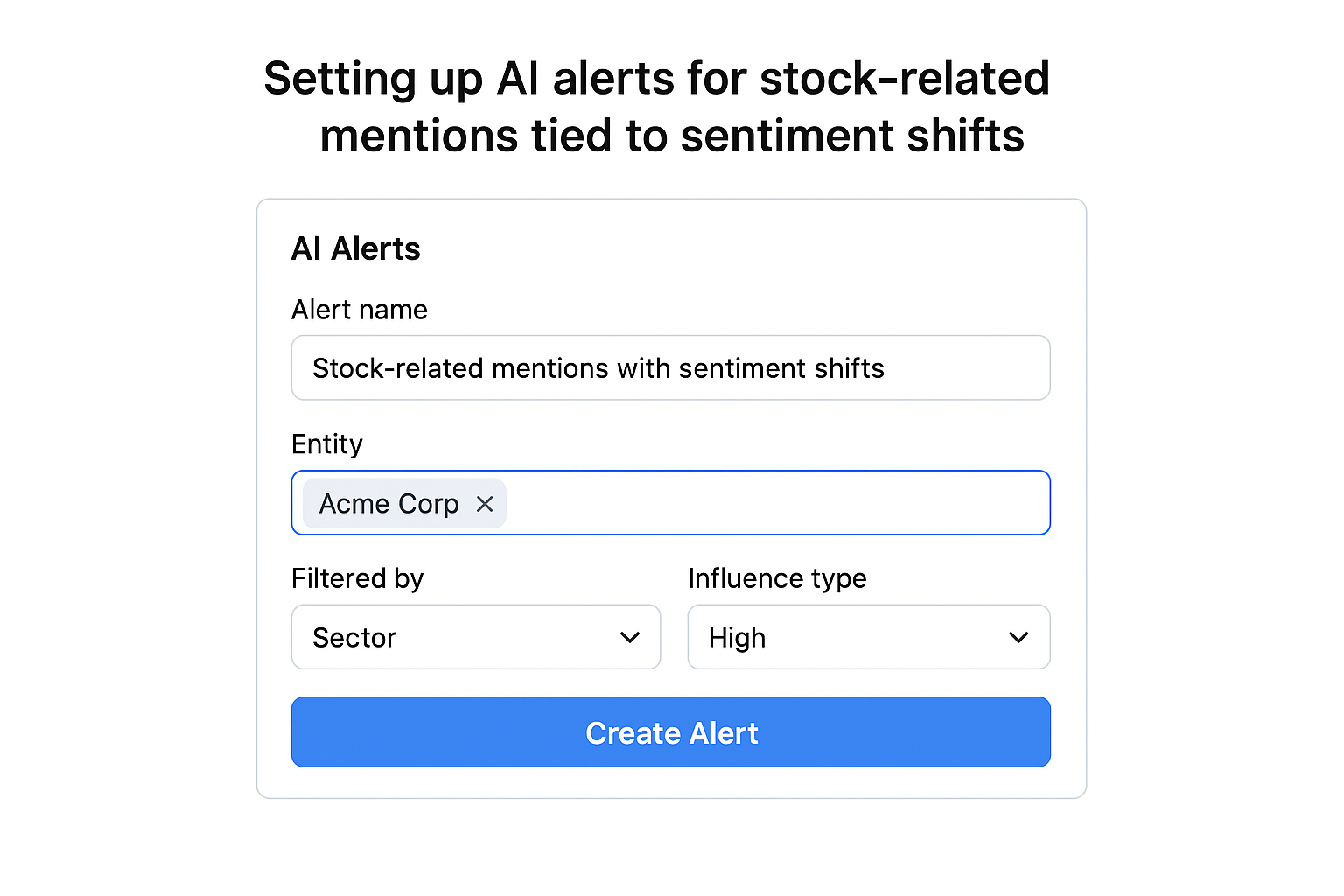

- Define Monitoring Parameters: Choose companies, tickers, executives, and key regulators relevant to your portfolio.

- Set Alert Triggers: Configure alerts for volume increases or sentiment shifts beyond your set thresholds.

- Link Signal to Action: Decide how each alert leads to further investigation, portfolio adjustments, or defensive hedging.

- Correlate with Other Data: Combine mention analysis with technical or fundamental metrics to contextualize alerts.

- Evaluate Outcomes: Track whether alerts correspond to meaningful price moves or confirmed events.

- Refine and Reduce Noise: Update filters regularly to balance sensitivity and precision.

ROI and Cost‑Benefit Analysis

While some assume premium mention‑tracking software is costly, the actual metric to monitor is return versus reaction time.

ROI Factors to Track:

- Number of actionable alerts that produced measurable advantage

- Reduction in manual monitoring hours

- Improved risk‑response timing

- Portfolio performance influenced by sentiment corrections

Cost Considerations: Subscription tiers, data coverage, and user seats. Free tools may track keywords but lack advanced filtering or precision scoring.

In practice, even mid‑tier plans pay for themselves through a few avoided losses or earlier entries into positive momentum plays. The goal is not to replace analyst research but to enhance human interpretation. AI doesn’t decide trades—it delivers sharper context.

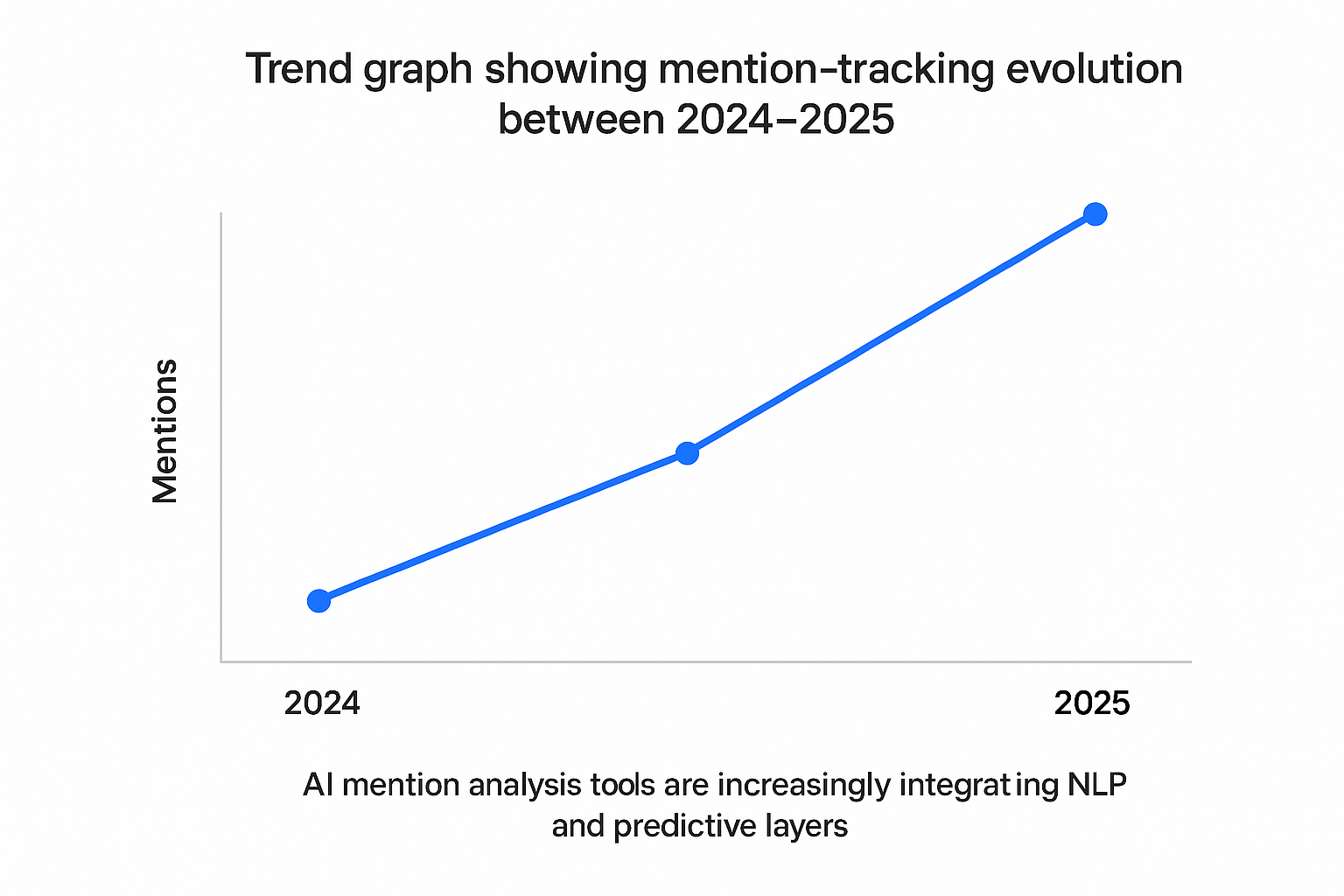

Emerging Trends in AI Mention‑Tracking

Mention‑tracking innovations align with broader shifts in generative AI and LLM technologies. In 2025, tools now integrate multi‑media data, transcribed audio, short‑form videos, and community posts. Key developments include:

- Scaling of sentiment analysis with transformer‑based models for better accuracy.

- Increased focus on ESG and regulatory mentions shaping sustainable investment decisions.

- Enhanced personalization, allowing retail investors access to dashboards once built for hedge funds.

- Hybrid AI models that filter false positives from meme stock noise, preserving data credibility.

This evolution signals that mention monitoring will soon merge seamlessly with predictive analytics, where correlation between talk and trend becomes a quantified signal, not speculation.

FAQ

Q1. What’s the difference between mention‑tracking and social listening?

Ans: Social listening looks at broad brand engagement; mention‑tracking narrows focus on financial impact, reputation risk, and investor‑specific insights.

Q2. Is it only for large companies?

Ans: No. Even small‑cap investors use AI mention‑tracking to stay ahead of sudden shifts in exposure or discussions.

Q3. Can retail investors afford this?

Ans: Yes. Many SaaS providers now offer flexible pricing tiers suitable for individuals.

Q4. How do you handle false signals?

Ans: By adjusting filters and applying sentiment thresholds; integrate historical data to benchmark anomalies.

Q5. Will it replace traditional research?

Ans: No. It complements existing methods by surfacing early indicators that inform deeper investigation.

Q6. Can mentions move a stock?

Ans: Indirectly, yes—because collective perception eventually influences analyst coverage and investor sentiment.

Conclusion

The investment landscape has changed from quarterly updates to continuous storylines. AI mention‑tracking software is how investors keep up. By converting unstructured conversation into measurable insights, it provides an informational edge once reserved for large institutions.

Investors who adopt mention tracking don’t just chase prices, they track narratives, detecting the emotional pulse behind movement. This blend of technology and insight defines the next competitive boundary in intelligent investing.

Before your next trade, explore mention‑tracking dashboards like LLMClicks.ai to evaluate how real‑time AI visibility tools, ChatGPT tracking means, and AI citation analytics can fortify research decisions.